Time period life insurance coverage is a well-liked choice for working households, and it’s straightforward to see why so many individuals spend money on the sort of protection. Clients can tailor a time period life insurance coverage coverage to their wants by selecting the coverage quantity and how lengthy it lasts. Time period life insurance coverage can also be way more reasonably priced than everlasting protection, and you may typically get authorised with no medical examination.

For those who’re out there for time period life insurance coverage, Bestow is a high supplier to contemplate. This firm enables you to buy time period life insurance coverage on-line in a matter of minutes, and also you gained’t must endure time spent on a medical examination. Premiums can be extremely reasonably priced (beginning at $10/month), and you may safe as much as $1.5 million in time period life insurance coverage that lasts for 10 to 30 years.

Life insurance coverage is an important part of any monetary plan, so it’s good to check up on the perfect life insurance coverage firms and all they’ve to supply. This complete evaluation explains Bestow’s coverage choices, how this firm works, and who it’s greatest for.

#ap70772-ww{font-family:Archivo,sans-serif}

#ap70772-ww{padding-top:20px;place:relative;text-align:middle;font-size:12px}#ap70772-ww #ap70772-ww-indicator{text-align:proper;shade:#4a4a4a}#ap70772-ww #ap70772-ww-indicator-wrapper{show:inline-flex;align-items:middle;justify-content:flex-end;margin-bottom:8px}#ap70772-ww #ap70772-ww-indicator-wrapper:hover #ap70772-ww-text{show:block}#ap70772-ww #ap70772-ww-indicator-wrapper:hover #ap70772-ww-label{show:none}#ap70772-ww #ap70772-ww-text{margin:auto 3px auto auto}#ap70772-ww #ap70772-ww-label{margin-left:4px;margin-right:3px}#ap70772-ww #ap70772-ww-icon{margin:auto;show:inline-block;width:16px;top:16px;min-width:16px;min-height:16px;cursor:pointer}#ap70772-ww #ap70772-ww-icon img{vertical-align:center;width:16px;top:16px;min-width:16px;min-height:16px}#ap70772-ww #ap70772-ww-text-bottom{margin:5px}

#ap70772-ww #ap70772-ww-text{show:none}#ap70772-ww #ap70772-ww-icon img{text-indent:-9999px;shade:clear}

In regards to the Firm

Based in 2016, Bestow is among the high suppliers of time period life insurance coverage with no medical examination. As a specialised time period life insurance coverage supplier, Bestow doesn’t promote different sorts of life insurance coverage to customers.

Its insurance policies are underwritten by North American Firm for Life and Well being Insurance coverage® which has an A+ score. It’s additionally reinsured by highly-rated Munich Re. This provides prospects the safety of figuring out that in the event that they ever must file a declare with the insurer, Bestow can comply with by.

Bestow operates completely on-line for added comfort, and customers can get a web based quote in a couple of minutes with out the stress of working with a life insurance coverage salesperson.

Bestow Merchandise and Providers

Bestow is a specialised life insurance coverage firm that solely provides one type of protection. It’s not for everybody, nevertheless it does provide a life insurance coverage product that’s straightforward for customers to buy and perceive.

Time period Life Insurance coverage

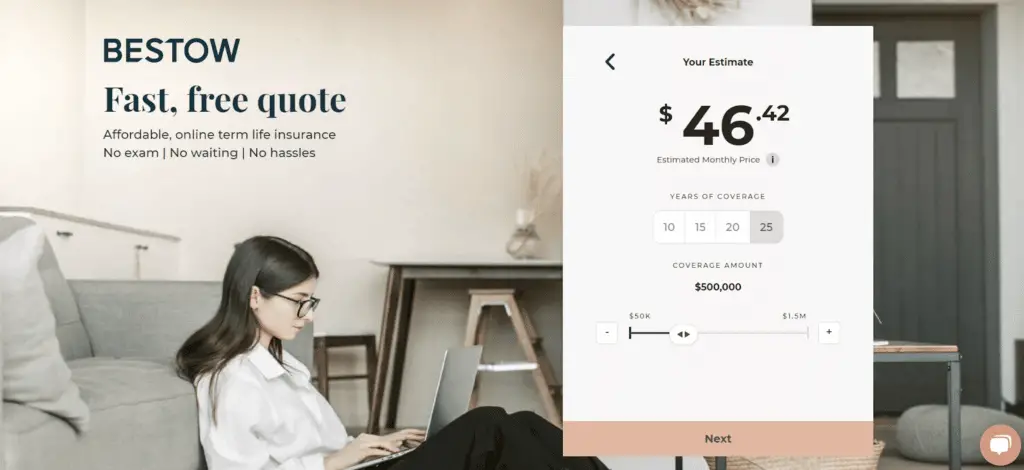

Time period life insurance coverage from Bestow can final for wherever from 10 to 30 years, and protection quantities can be found from $50,000 to $1.5 million. Potential prospects can tailor their protection to their distinctive wants, shopping for solely the quantity of protection they need.

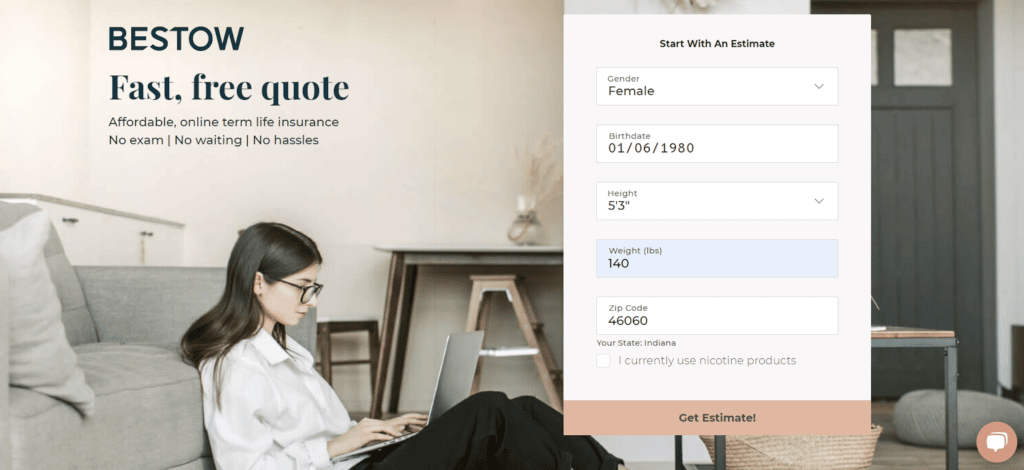

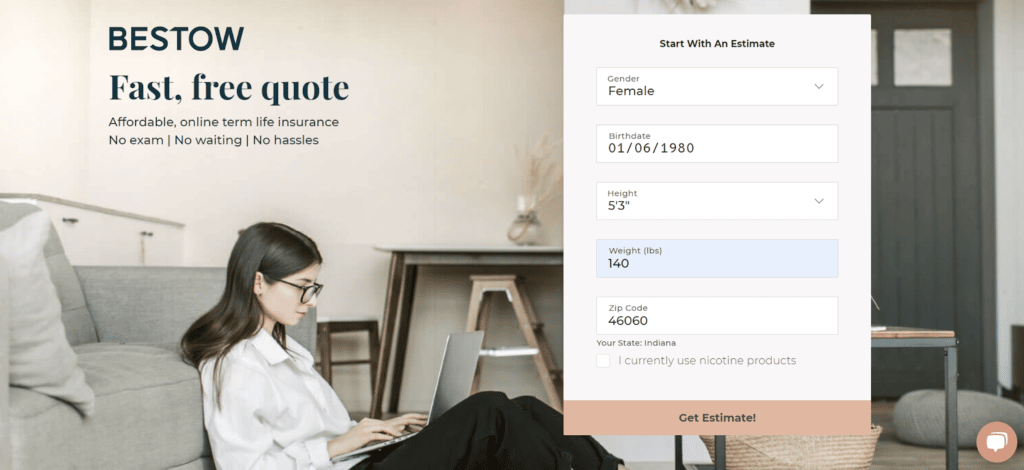

When requesting a quote, prospects don’t even have to supply many private particulars. Merely get began by clicking on “get a quote” and getting into easy data like your gender, birthdate, top, weight, and zip code.

When you enter these primary particulars, you’ll obtain an prompt quote for time period life insurance coverage protection. Nevertheless, you get the prospect to tailor your coverage from there, both by growing or lowering the protection quantity or switching the size of your coverage.

For those who’re pleased along with your time period life insurance coverage quote, click on “subsequent” to fill out a full life insurance coverage utility. If authorised, your time period coverage will start with no requirement for a medical examination.

Distinctive Options

Since Bestow solely provides time period life insurance coverage protection, its coverage choices aren’t difficult in any respect. Listed here are some necessary options to know:

- Bestow provides a referral program for present policyholders. This program enables you to earn a present card for every buddy you refer who purchases a life insurance coverage coverage. Bestow prospects can refer as much as 10 individuals whole.

- Bestow provides accelerated underwriting. Its on-line, hassle-free life insurance coverage doesn’t require a medical examination of any type. As an alternative of medical exams, it approves you for a coverage primarily based on superior algorithms and proprietary information.

- Bestow provides a 30-day a refund assure. For those who’re sad along with your coverage and also you cancel inside 30 days, you’ll obtain a refund of premiums paid.

Who Bestow Is Finest For

Bestow is a wonderful alternative for customers who need to purchase time period life insurance coverage protection with minimal trouble. Since you possibly can enter some primary data and get protection with out spending the time present process a medical examination, Bestow’s choices are perfect for busy, working individuals.

Be aware that Bestow insurance policies are solely accessible to people who’re ages 18 to 60, and folks with a felony conviction aren’t eligible for protection. Additionally Bestow’s doesn’t provide the choice for riders, so that you take into account different choices if you wish to tailor your coverage with riders for unintended dying, an accelerated dying profit or the rest.

Bestow Is Finest For:

- Customers ages 18 to 60 who’re keen to purchase life insurance coverage with minimal trouble and stress

- Individuals who need time period life insurance coverage protection that lasts for a selected timeline, akin to their working years

- Anybody who needs to purchase life insurance coverage with out coping with a life insurance coverage agent

- Customers who’re comfy dealing with necessary points of their funds on-line

Bestow vs. Different On-line Life Insurance coverage Firms

Though Bestow is exclusive in that it provides online-only time period life insurance coverage protection, it’s not the one supplier on this area. Fairly a couple of different startups provide related protection choices with the identical hassle-free on-line quoting system.

For those who’re positively out there for time period life insurance coverage protection, however need the perfect premiums, be certain to get a life insurance coverage quote from at the least two to a few completely different firms.

| Bestow | Haven Life | Ethos | |

| Obtainable Insurance policies | Time period Life Insurance coverage, 10 to 30 yr phrases | Time period Life Insurance coverage, 10 to 30 years | Time period Life Insurance coverage, 10 to 30 years Assured Situation Entire Life Insurance coverage |

| Protection Quantities | $50,000 to $1.5 million | $100,000 to $3 million | $100,000 to $1.5 million Assured Situation Entire Life Insurance coverage as much as $25,000 |

| Medical Examination Required | No | Not at all times | Not at all times |

| Cash-Again Assure | Sure | No | Sure |

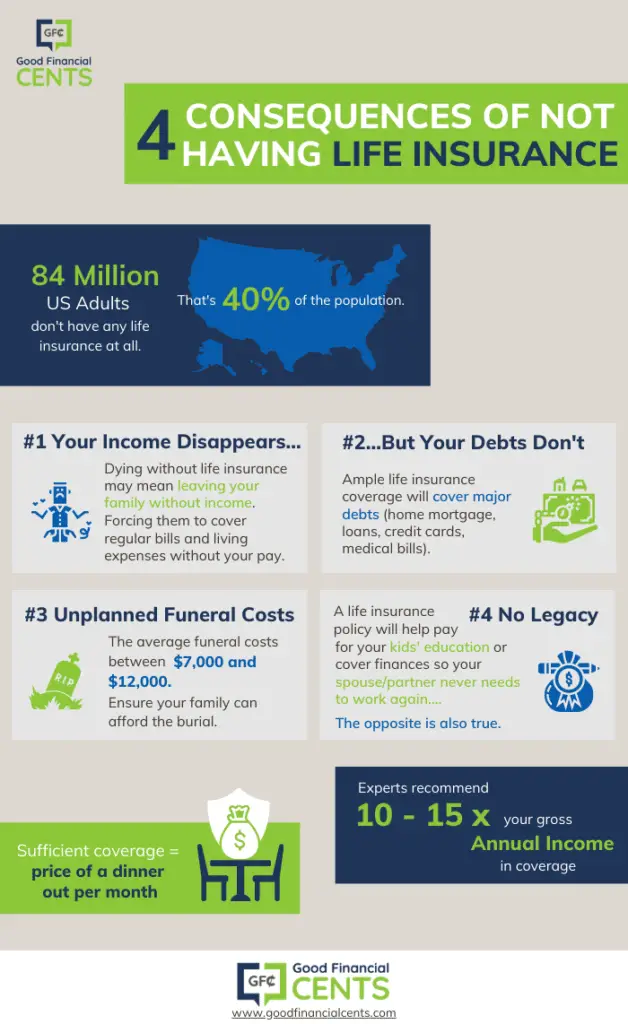

What To Know About Time period Life Insurance coverage

Earlier than buying time period life insurance coverage from Bestow or every other firm, it helps to know in regards to the different sorts of life insurance coverage on the market, and who they’re greatest for. Though it’s not for everybody, everlasting life insurance coverage has sure advantages, together with lifetime insurance policies and their means to construct money worth.

Finally, you may need to dive into the entire life insurance coverage vs. time period life insurance coverage debate earlier than investing in a coverage.

Not having to talk to a Bestow agent earlier than buying a life insurance coverage coverage is a serious perk. However this additionally means you’ll have to determine a couple of particulars by yourself, like how a lot life insurance coverage protection you want.

#ap3010-ww{font-family:Archivo,sans-serif}

#ap3010-ww{padding-top:20px;place:relative;text-align:middle;font-size:12px}#ap3010-ww #ap3010-ww-indicator{text-align:proper;shade:#4a4a4a}#ap3010-ww #ap3010-ww-indicator-wrapper{show:inline-flex;align-items:middle;justify-content:flex-end;margin-bottom:8px}#ap3010-ww #ap3010-ww-indicator-wrapper:hover #ap3010-ww-text{show:block}#ap3010-ww #ap3010-ww-indicator-wrapper:hover #ap3010-ww-label{show:none}#ap3010-ww #ap3010-ww-text{margin:auto 3px auto auto}#ap3010-ww #ap3010-ww-label{margin-left:4px;margin-right:3px}#ap3010-ww #ap3010-ww-icon{margin:auto;show:inline-block;width:16px;top:16px;min-width:16px;min-height:16px;cursor:pointer}#ap3010-ww #ap3010-ww-icon img{vertical-align:center;width:16px;top:16px;min-width:16px;min-height:16px}#ap3010-ww #ap3010-ww-text-bottom{margin:5px}

#ap3010-ww #ap3010-ww-text{show:none}#ap3010-ww #ap3010-ww-icon img{text-indent:-9999px;shade:clear}