It’s typically mentioned that “numbers don’t lie”. If that’s the case, what does that reveal about private finance within the USA? To reply that query, we’ve ready this evaluation of private finance details and statistics that will help you perceive roughly the place you’re as compared with different Individuals.

The knowledge revealed in our evaluation isn’t supposed to make you’re feeling insecure in any means. As a substitute, it’s designed to assist set parameters that may allow you to see how you’re doing and to make enhancements the place you imagine it’s essential.

We hope you want numbers as a result of we have now loads of them! They’re a essential evil, and so they go along with the territory in relation to private finance. We’re going to current statistics regarding a number of matters regarding earnings, debt, financial savings and budgeting, and monetary planning.

The median family earnings nationwide is $79,900. However there’s a large variation between the person states. The next median family earnings statistics are supplied by the US Division of Housing and City Growth, as of April 1, 2021:

| State | Median Family Revenue |

| Alabama | $66,700 |

| Alaska | $93,900 |

| Arizona | $73,200 |

| Arkansas | $60,700 |

| California | $90,100 |

| Colorado | $93,000 |

| Connecticut | $102,600 |

| Delaware | $83,000 |

| District of Columbia | $123,100 |

| Florida | $70,000 |

| Georgia | $74,700 |

| Hawaii | $99,800 |

| Idaho | $69,000 |

| Illinois | $85,000 |

| Indiana | $73,300 |

| Iowa | $79,500 |

| Kansas | $77,400 |

| Kentucky | $65,100 |

| Louisiana | $64,700 |

| Maine | $75,700 |

| Maryland | $106,000 |

| Massachusetts | $106,200 |

| Michigan | $75,300 |

| Minnesota | $93,100 |

| Mississippi | $60,000 |

| Missouri | $72,300 |

| Montana | $72,100 |

| Nebraska | $79,400 |

| Nevada | $75,100 |

| New Hampshire | $98,200 |

| New Jersey | $106,000 |

| New Mexico | $61,400 |

| New York | $87,100 |

| North Carolina | $70,900 |

| North Dakota | $90,100 |

| Ohio | $75,300 |

| Oklahoma | $67,000 |

| Oregon | $81,200 |

| Pennsylvania | $81,000 |

| Rhode Island | $88,000 |

| South Carolina | $68,700 |

| South Dakota | $75,500 |

| Tennessee | $68,600 |

| Texas | $75,100 |

| Utah | $85,300 |

| Vermont | $84,100 |

| Virginia | $93,000 |

| Washington | $91,600 |

| West Virginia | $60,300 |

| Wisconsin | $80,300 |

| Wyoming | $81,900 |

| US | $79,900 |

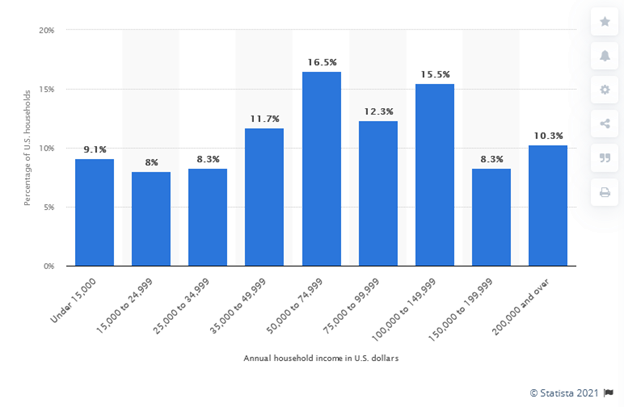

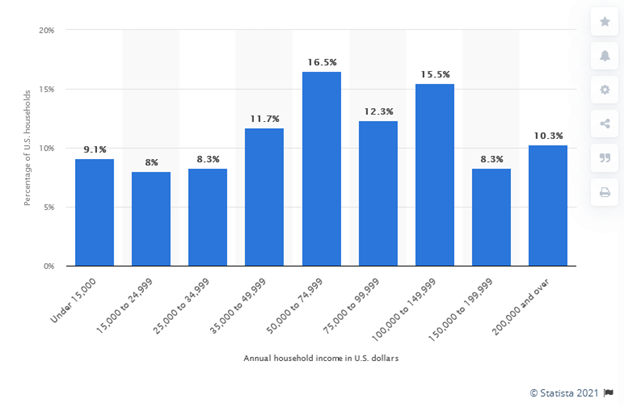

Have you ever ever questioned the place your earnings falls amongst wage earners nationwide? For instance, you might have an interest to know that in case your family earnings is over $200,000 per 12 months, you’re among the many 10.3% wealthiest households within the nation.

In keeping with Statista, the earnings distribution within the US is as follows (for 2019):

In keeping with the U.S. Census Bureau, 10.5% of the inhabitants – or about 34 million individuals – had been beneath the poverty line in 2019.

In keeping with the US Workplace of the Assistant Secretary for Planning and Analysis (ASPE) the poverty line for 2019 is as follows (primarily based on annual earnings by family measurement) for a lot of the nation:

- One individual – $12,490

- Two individuals – $16,910

- Three individuals – $21,330

- 4 individuals – $25,750

- 5 individuals – $30,170

- Six individuals – $34,590

- Seven individuals – $39,010

- Eight individuals – $43,430

Primarily based on the desk for “Median Family Revenue Per State” supplied by the US Division of Housing and City Growth within the first part above, the highest 5 richest states within the USA are:

- Massachusetts, $106,200

- Maryland, $106,000

- New Jersey, $106,000

- Connecticut, $102,600

- Hawaii, $99,800

Primarily based on the desk for “Median Family Revenue Per State” supplied by the US Division of Housing and City Growth within the first part above, the highest 5 poorest states within the USA are:

- Mississippi, $60,000

- West Virginia, $60,300

- Arkansas, $60,700

- New Mexico, $61,400

- Louisiana, $64,700

In keeping with the Bureau of Labor Statistics (BLS), earnings per training degree is as follows (for 2017):

| Training Degree | Imply traditional weekly earnings | Annual earnings |

| Doctoral diploma | $1,743 | $90,636 |

| Skilled diploma | $1,836 | $95,472 |

| Grasp’s diploma | $1,401 | $72,852 |

| Bachelor’s diploma | $1,173 | $60,996 |

| Affiliate’s diploma | $836 | $43,472 |

| Some school, no diploma | $774 | $40,248 |

| Highschool diploma, no school | $712 | $37,024 |

| Lower than a highschool diploma | $520 | $27,040 |

| Common for all training ranges | $907 | $47,164 |

In keeping with the US Bureau of Labor Statistics, median earnings by age bracket are as follows (for the second quarter of 2021):

| Age Bracket | Imply traditional weekly earnings | Annual earnings |

| 16 to 24 | $619 | $32,188 |

| 25 to 34 | $928 | $48,256 |

| 35 to 44 | $1,119 | $58,188 |

| 45 to 54 | $1,134 | $58,968 |

| 55 to 64 | $1,130 | $58,760 |

| 65 and over | $989 | $51,428 |

Common annual shopper spending within the USA was $63,036 in 2019, in line with the Bureau of Labor Statistics.

The largest particular person class bills had been:

- Housing, $20,679

- Transportation, $10,742

- Meals, $8,169

- Private insurance coverage and pensions, $7,165

- Well being, $5,193

Whole shopper debt within the USA is $14.96 trillion. These are the statistics issued by the Federal Reserve Financial institution of New York for the second quarter of 2021. That features all types of shopper debt, together with dwelling mortgages, pupil loans, bank cards, and auto loans.

The quantity of bank card debt within the USA is $807 billion. The common bank card debt per household is $6,270, and 45.4% of households carry some quantity of bank card debt. (Supply: Worth Penguin)

The common American family pays $1,045.55 in bank card curiosity every year. It’s totally probably the typical American has no strong concept how a lot she or he is paying, as a consequence of a number of bank cards, and the variable nature of each bank card balances and rates of interest.

About 2 million automotive repossessions yearly within the USA (supply: Etags.com). Automobiles are usually repossessed inside 90 days of mortgage default (your final cost).

The entire quantity of pupil mortgage debt within the USA is a file $1.71 trillion as of the start of 2021 (supply: StudentLoanHero.com).

44.7 million college students and graduates owe a median of practically $30,000 in pupil mortgage debt. However pupil mortgage money owed taken by dad and mom for the advantage of their kids averaged $37,200 per borrower.

544,463 Individuals file for chapter every year, together with 522,808 private bankruptcies. The remaining are enterprise bankruptcies. (Supply: US Courts.gov.)

Of the overall, 378,953 had been Chapter 7 bankruptcies, representing complete and quick chapter. 156,377 had been Chapter 13 bankruptcies, representing partial bankruptcies, largely settled by installment funds.

45% of Individuals haven’t any financial savings in any respect (supply: GOBankingRates).

The knowledge is a bit dated, however in line with a survey carried out by CareerBuilder in 2017, 78% of Individuals dwell paycheck-to-paycheck. This consists of totally 10% of households with annual incomes of $100,000 or extra.

Solely 41% of Individuals have a funds, in line with LendEdu.com.

Solely 39% of Individuals manage to pay for of their financial savings to cowl a $1,000 emergency, in line with a survey taken by Bankrate and launched initially of 2021. Many of the relaxation reported they’d get the funds from bank cards, private loans, or borrowing from household and buddies.

Individuals paid $11.8 billion in overdraft charges in 2020. Most of those charges had been paid by people thought of to be financially weak. (Supply: Forbes.)

The common quantity of financial savings per American is $17,135, as of November 2020. That’s the nationwide common, nevertheless state averages fluctuate significantly. The common in West Virginia is $6,936 (the bottom), whereas the typical in South Dakota is $24,497 (the very best).